Personal wealth planning involves setting realistic financial goals and devising genius strategies. A good planner will have a well-detailed plan of their current income, total savings, and investments.

All these financial details help you create a good foundation for building wealth.

What Does Personal Wealth Planning Entail?

Financial planning involves specific steps to enjoy long-term financial stability. Here the major steps you must take note of to plan successfully.

Set a few practical financial goals

A complete wealth plan must include well-detailed financial goals. Common objectives involve owning a home and a car by a stipulated age. The essence of these goals is to inspire you to work hard and have a better life in the future.

Earn a good income

Secondly, one needs to get a well-paying job to get a decent income to pay for basic needs and save the remainder. Businesspeople and professionals make a relatively adequate income than casual laborers. Therefore, they can get a sizeable monthly income and save more money.

Saving

The third step is to develop a habit of saving a certain percentage of their income. A wealth plan must stipulate what percentage of their revenue goes to their savings account.

Invest your savings

Once you save enough money, you can go ahead and start investing. You may invest in the real estate industry, company shares, or government bonds.

Why I Endorse Personal Wealth Planners

I will never tire of recommending hiring personal wealth planners to people. Let us see the significance of hiring a certified financial management advisor.

To make sound investment decisions.

All certified financial planners understand different investment ventures. Therefore, they can stand by and watch their clients make costly investment mistakes. For example, they can advise them on the right company to invest in (shares).

They help create financial goals.

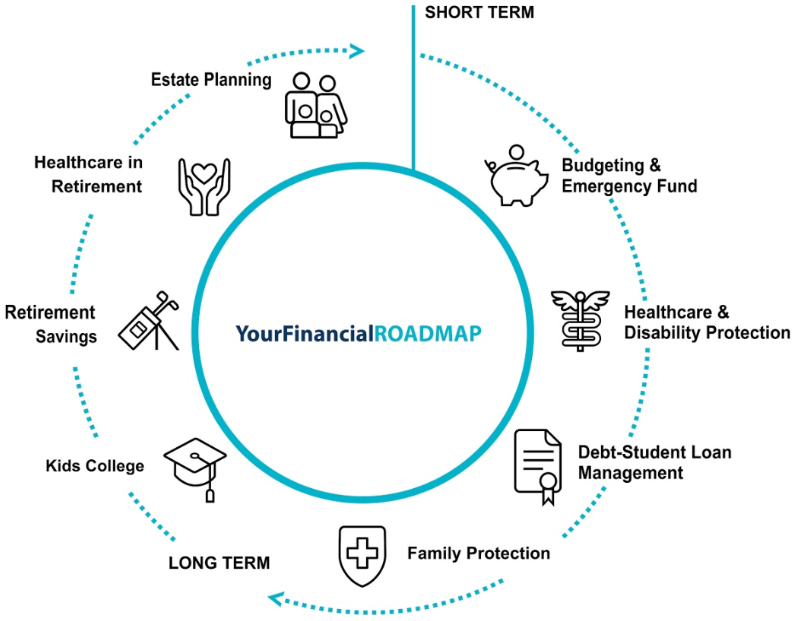

Secondly, these financial experts work with their clients to set realistic short-term and long-term goals. Usually, the monthly income informs the goals the wealth planner will set for you.

File taxes

Fortunately, modern wedding planners are proficient in filing taxes. Therefore, they can help their clients to pay taxes as required to help them build wealth. You wouldn’t want the taxman to demand a ridiculous amount of tax after some time.

Conclusion

Today, all affluent people in the world are efficient in personal wealth planning. They fully get the key steps to follow to build generational wealth. What all these billionaires have in common is that they hire professional wealth planners.